Engineering and Mining Journal - Whether the market is copper, gold, nickel, iron ore, lead/zinc, PGM, diamonds or other commodities, E&MJ takes the lead in projecting trends, following development and reporting on the most efficient operating pr

Issue link: https://emj.epubxp.com/i/938385

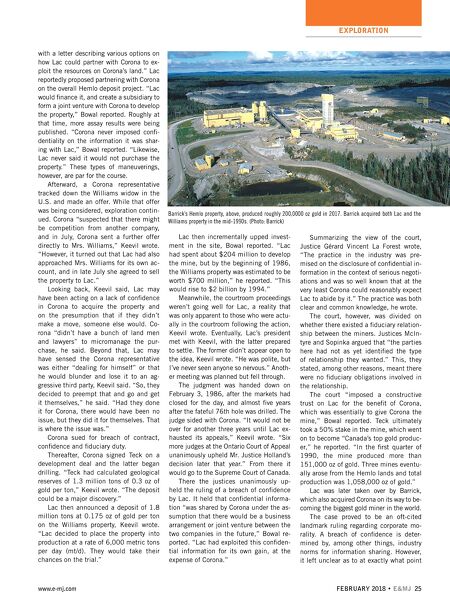

EXPLORATION FEBRUARY 2018 • E&MJ; 25 www.e-mj.com with a letter describing various options on how Lac could partner with Corona to ex- ploit the resources on Corona's land." Lac reportedly proposed partnering with Corona on the overall Hemlo deposit project. "Lac would finance it, and create a subsidiary to form a joint venture with Corona to develop the property," Bowal reported. Roughly at that time, more assay results were being published. "Corona never imposed confi- dentiality on the information it was shar- ing with Lac," Bowal reported. "Likewise, Lac never said it would not purchase the property." These types of maneuverings, however, are par for the course. Afterward, a Corona representative tracked down the Williams widow in the U.S. and made an offer. While that offer was being considered, exploration contin- ued. Corona "suspected that there might be competition from another company, and in July, Corona sent a further offer directly to Mrs. Williams," Keevil wrote. "However, it turned out that Lac had also approached Mrs. Williams for its own ac- count, and in late July she agreed to sell the property to Lac." Looking back, Keevil said, Lac may have been acting on a lack of confidence in Corona to acquire the property and on the presumption that if they didn't make a move, someone else would. Co- rona "didn't have a bunch of land men and lawyers" to micromanage the pur- chase, he said. Beyond that, Lac may have sensed the Corona representative was either "dealing for himself" or that he would blunder and lose it to an ag- gressive third party, Keevil said. "So, they decided to preempt that and go and get it themselves," he said. "Had they done it for Corona, there would have been no issue, but they did it for themselves. That is where the issue was." Corona sued for breach of contract, confidence and fiduciary duty. Thereafter, Corona signed Teck on a development deal and the latter began drilling. "Teck had calculated geological reserves of 1.3 million tons of 0.3 oz of gold per ton," Keevil wrote. "The deposit could be a major discovery." Lac then announced a deposit of 1.8 million tons at 0.175 oz of gold per ton on the Williams property, Keevil wrote. "Lac decided to place the property into production at a rate of 6,000 metric tons per day (mt/d). They would take their chances on the trial." Lac then incrementally upped invest- ment in the site, Bowal reported. "Lac had spent about $204 million to develop the mine, but by the beginning of 1986, the Williams property was estimated to be worth $700 million," he reported. "This would rise to $2 billion by 1994." Meanwhile, the courtroom proceedings weren't going well for Lac, a reality that was only apparent to those who were actu- ally in the courtroom following the action, Keevil wrote. Eventually, Lac's president met with Keevil, with the latter prepared to settle. The former didn't appear open to the idea, Keevil wrote. "He was polite, but I've never seen anyone so nervous." Anoth- er meeting was planned but fell through. The judgment was handed down on February 3, 1986, after the markets had closed for the day, and almost five years after the fateful 76th hole was drilled. The judge sided with Corona. "It would not be over for another three years until Lac ex- hausted its appeals," Keevil wrote. "Six more judges at the Ontario Court of Appeal unanimously upheld Mr. Justice Holland's decision later that year." From there it would go to the Supreme Court of Canada. There the justices unanimously up- held the ruling of a breach of confidence by Lac. It held that confidential informa- tion "was shared by Corona under the as- sumption that there would be a business arrangement or joint venture between the two companies in the future," Bowal re- ported. "Lac had exploited this confiden- tial information for its own gain, at the expense of Corona." Summarizing the view of the court, Justice Gérard Vincent La Forest wrote, "The practice in the industry was pre- mised on the disclosure of confidential in- formation in the context of serious negoti- ations and was so well known that at the very least Corona could reasonably expect Lac to abide by it." The practice was both clear and common knowledge, he wrote. The court, however, was divided on whether there existed a fiduciary relation- ship between the miners. Justices McIn- tyre and Sopinka argued that "the parties here had not as yet identified the type of relationship they wanted." This, they stated, among other reasons, meant there were no fiduciary obligations involved in the relationship. The court "imposed a constructive trust on Lac for the benefit of Corona, which was essentially to give Corona the mine," Bowal reported. Teck ultimately took a 50% stake in the mine, which went on to become "Canada's top gold produc- er," he reported. "In the first quarter of 1990, the mine produced more than 151,000 oz of gold. Three mines eventu- ally arose from the Hemlo lands and total production was 1,058,000 oz of gold." Lac was later taken over by Barrick, which also acquired Corona on its way to be- coming the biggest gold miner in the world. The case proved to be an oft-cited landmark ruling regarding corporate mo- rality. A breach of confidence is deter- mined by, among other things, industry norms for information sharing. However, it left unclear as to at exactly what point Barrick's Hemlo property, above, produced roughly 200,0000 oz gold in 2017. Barrick acquired both Lac and the Williams property in the mid-1990s. (Photo: Barrick)