Engineering and Mining Journal - Whether the market is copper, gold, nickel, iron ore, lead/zinc, PGM, diamonds or other commodities, E&MJ takes the lead in projecting trends, following development and reporting on the most efficient operating pr

Issue link: https://emj.epubxp.com/i/981569

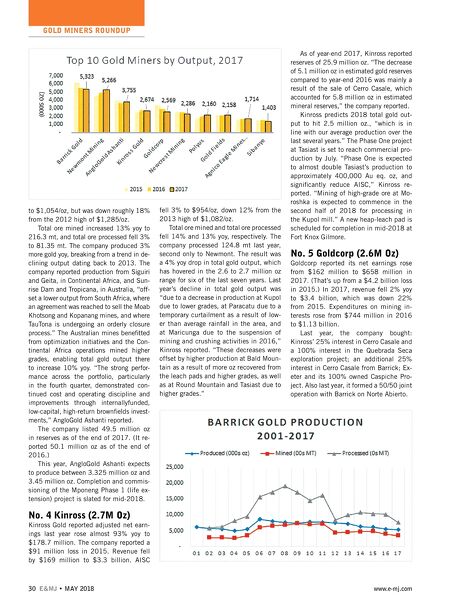

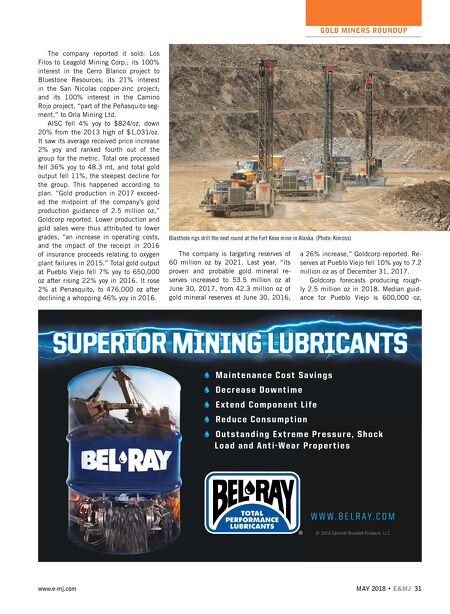

GOLD MINERS ROUNDUP 30 E&MJ; • MAY 2018 www.e-mj.com to $1,054/oz, but was down roughly 18% from the 2012 high of $1,285/oz. Total ore mined increased 13% yoy to 216.3 mt, and total ore processed fell 3% to 81.35 mt. The company produced 3% more gold yoy, breaking from a trend in de- clining output dating back to 2013. The company reported production from Siguiri and Geita, in Continental Africa, and Sun- rise Dam and Tropicana, in Australia, "off- set a lower output from South Africa, where an agreement was reached to sell the Moab Khotsong and Kopanang mines, and where TauTona is undergoing an orderly closure process." The Australian mines benefitted from optimization initiatives and the Con- tinental Africa operations mined higher grades, enabling total gold output there to increase 10% yoy. "The strong perfor- mance across the portfolio, particularly in the fourth quarter, demonstrated con- tinued cost and operating discipline and improvements through internallyfunded, low-capital, high-return brownfields invest- ments," AngloGold Ashanti reported. The company listed 49.5 million oz in reserves as of the end of 2017. (It re- ported 50.1 million oz as of the end of 2016.) This year, AngloGold Ashanti expects to produce between 3.325 million oz and 3.45 million oz. Completion and commis- sioning of the Mponeng Phase 1 (life ex- tension) project is slated for mid-2018. No. 4 Kinross (2.7M Oz) Kinross Gold reported adjusted net earn - ings last year rose almost 93% yoy to $178.7 million. The company reported a $91 million loss in 2015. Revenue fell by $169 million to $3.3 billion. AISC fell 3% to $954/oz, down 12% from the 2013 high of $1,082/oz. Total ore mined and total ore processed fell 14% and 13% yoy, respectively. The company processed 124.8 mt last year, second only to Newmont. The result was a 4% yoy drop in total gold output, which has hovered in the 2.6 to 2.7 million oz range for six of the last seven years. Last year's decline in total gold output was "due to a decrease in production at Kupol due to lower grades, at Paracatu due to a temporary curtailment as a result of low- er than average rainfall in the area, and at Maricunga due to the suspension of mining and crushing activities in 2016," Kinross reported. "These decreases were offset by higher production at Bald Moun- tain as a result of more oz recovered from the leach pads and higher grades, as well as at Round Mountain and Tasiast due to higher grades." As of year-end 2017, Kinross reported reserves of 25.9 million oz. "The decrease of 5.1 million oz in estimated gold reserves compared to year-end 2016 was mainly a result of the sale of Cerro Casale, which accounted for 5.8 million oz in estimated mineral reserves," the company reported. Kinross predicts 2018 total gold out- put to hit 2.5 million oz., "which is in line with our average production over the last several years." The Phase One project at Tasiast is set to reach commercial pro- duction by July. "Phase One is expected to almost double Tasiast's production to approximately 400,000 Au eq. oz, and significantly reduce AISC," Kinross re- ported. "Mining of high-grade ore at Mo- roshka is expected to commence in the second half of 2018 for processing in the Kupol mill." A new heap-leach pad is scheduled for completion in mid-2018 at Fort Knox Gilmore. No. 5 Goldcorp (2.6M Oz) Goldcorp reported its net earnings rose from $162 million to $658 million in 2017. (That's up from a $4.2 billion loss in 2015.) In 2017, revenue fell 2% yoy to $3.4 billion, which was down 22% from 2015. Expenditures on mining in- terests rose from $744 million in 2016 to $1.13 billion. Last year, the company bought: Kinross' 25% interest in Cerro Casale and a 100% interest in the Quebrada Seca exploration project; an additional 25% interest in Cerro Casale from Barrick; Ex- eter and its 100% owned Caspiche Pro- ject. Also last year, it formed a 50/50 joint operation with Barrick on Norte Abierto.