Engineering and Mining Journal - Whether the market is copper, gold, nickel, iron ore, lead/zinc, PGM, diamonds or other commodities, E&MJ takes the lead in projecting trends, following development and reporting on the most efficient operating pr

Issue link: https://emj.epubxp.com/i/981569

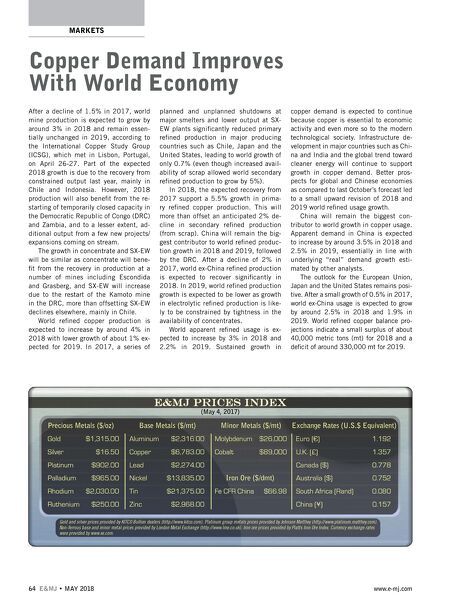

64 E&MJ; • MAY 2018 www.e-mj.com MARKETS After a decline of 1.5% in 2017, world mine production is expected to grow by around 3% in 2018 and remain essen- tially unchanged in 2019, according to the International Copper Study Group (ICSG), which met in Lisbon, Portugal, on April 26-27. Part of the expected 2018 growth is due to the recovery from constrained output last year, mainly in Chile and Indonesia. However, 2018 production will also benefi t from the re- starting of temporarily closed capacity in the Democratic Republic of Congo (DRC) and Zambia, and to a lesser extent, ad- ditional output from a few new projects/ expansions coming on stream. The growth in concentrate and SX-EW will be similar as concentrate will bene- fi t from the recovery in production at a number of mines including Escondida and Grasberg, and SX-EW will increase due to the restart of the Kamoto mine in the DRC, more than offsetting SX-EW declines elsewhere, mainly in Chile. World refi ned copper production is expected to increase by around 4% in 2018 with lower growth of about 1% ex- pected for 2019. In 2017, a series of planned and unplanned shutdowns at major smelters and lower output at SX- EW plants signifi cantly reduced primary refi ned production in major producing countries such as Chile, Japan and the United States, leading to world growth of only 0.7% (even though increased avail- ability of scrap allowed world secondary refi ned production to grow by 5%). In 2018, the expected recovery from 2017 support a 5.5% growth in prima- ry refi ned copper production. This will more than offset an anticipated 2% de- cline in secondary refi ned production (from scrap). China will remain the big- gest contributor to world refi ned produc- tion growth in 2018 and 2019, followed by the DRC. After a decline of 2% in 2017, world ex-China refi ned production is expected to recover signifi cantly in 2018. In 2019, world refi ned production growth is expected to be lower as growth in electrolytic refi ned production is like- ly to be constrained by tightness in the availability of concentrates. World apparent refi ned usage is ex- pected to increase by 3% in 2018 and 2.2% in 2019. Sustained growth in copper demand is expected to continue because copper is essential to economic activity and even more so to the modern technological society. Infrastructure de- velopment in major countries such as Chi- na and India and the global trend toward cleaner energy will continue to support growth in copper demand. Better pros- pects for global and Chinese economies as compared to last October's forecast led to a small upward revision of 2018 and 2019 world refi ned usage growth. China will remain the biggest con- tributor to world growth in copper usage. Apparent demand in China is expected to increase by around 3.5% in 2018 and 2.5% in 2019, essentially in line with underlying "real" demand growth esti- mated by other analysts. The outlook for the European Union, Japan and the United States remains posi- tive. After a small growth of 0.5% in 2017, world ex-China usage is expected to grow by around 2.5% in 2018 and 1.9% in 2019. World refi ned copper balance pro- jections indicate a small surplus of about 40,000 metric tons (mt) for 2018 and a defi cit of around 330,000 mt for 2019. Copper Demand Improves With World Economy Gold and silver prices provided by KITCO Bullion dealers (http://www.kitco.com). Platinum group metals prices provided by Johnson Matthey (http://www.platinum.matthey.com). Non-ferrous base and minor metal prices provided by London Metal Exchange (http://www.lme.co.uk). Iron ore prices provided by Platts Iron Ore Index. Currency exchange rates were provided by www.xe.com. (May 4, 2017) Precious Metals ($/oz) Base Metals ($/mt) Minor Metals ($/mt) Exchange Rates (U.S.$ Equivalent) Gold $1,315.00 Aluminum $2,316.00 Molybdenum $26,000 Euro (€) 1.192 Silver $16.50 Copper $6,783.00 Cobalt $89,000 U.K. (£) 1.357 Platinum $902.00 Lead $2,274.00 Canada ($) 0.778 Palladium $965.00 Nickel $13,835.00 Iron Ore ($/dmt) Australia ($) 0.752 Rhodium $2,030.00 Tin $21,375.00 Fe CFR China $66.98 South Africa (Rand) 0.080 Ruthenium $250.00 Zinc $2,968.00 China (¥) 0.157