Engineering and Mining Journal - Whether the market is copper, gold, nickel, iron ore, lead/zinc, PGM, diamonds or other commodities, E&MJ takes the lead in projecting trends, following development and reporting on the most efficient operating pr

Issue link: https://emj.epubxp.com/i/98266

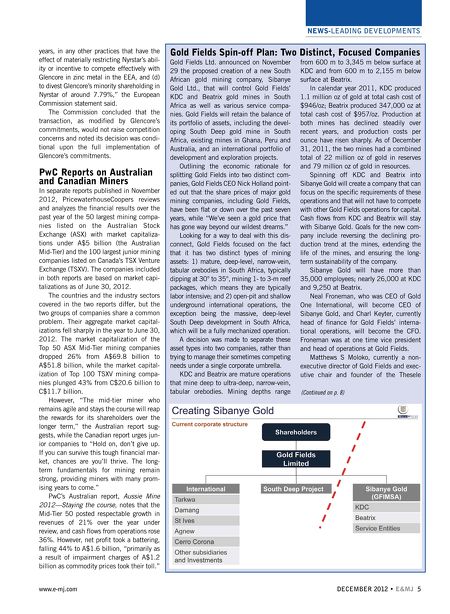

NEWS-LEADING DEVELOPMENTS years, in any other practices that have the effect of materially restricting Nyrstar's ability or incentive to compete effectively with Glencore in zinc metal in the EEA, and (d) to divest Glencore's minority shareholding in Nyrstar of around 7.79%," the European Commission statement said. The Commission concluded that the transaction, as modified by Glencore's commitments, would not raise competition concerns and noted its decision was conditional upon the full implementation of Glencore's commitments. PwC Reports on Australian and Canadian Miners In separate reports published in November 2012, PricewaterhouseCoopers reviews and analyzes the financial results over the past year of the 50 largest mining companies listed on the Australian Stock Exchange (ASX) with market capitalizations under A$5 billion (the Australian Mid-Tier) and the 100 largest junior mining companies listed on Canada's TSX Venture Exchange (TSXV). The companies included in both reports are based on market capitalizations as of June 30, 2012. The countries and the industry sectors covered in the two reports differ, but the two groups of companies share a common problem. Their aggregate market capitalizations fell sharply in the year to June 30, 2012. The market capitalization of the Top 50 ASX Mid-Tier mining companies dropped 26% from A$69.8 billion to A$51.8 billion, while the market capitalization of Top 100 TSXV mining companies plunged 43% from C$20.6 billion to C$11.7 billion. However, "The mid-tier miner who remains agile and stays the course will reap the rewards for its shareholders over the longer term," the Australian report suggests, while the Canadian report urges junior companies to "Hold on, don't give up. If you can survive this tough financial market, chances are you'll thrive. The longterm fundamentals for mining remain strong, providing miners with many promising years to come." PwC's Australian report, Aussie Mine 2012—Staying the course, notes that the Mid-Tier 50 posted respectable growth in revenues of 21% over the year under review, and cash flows from operations rose 36%. However, net profit took a battering, falling 44% to A$1.6 billion, "primarily as a result of impairment charges of A$1.2 billion as commodity prices took their toll." www.e-mj.com Gold Fields Spin-off Plan: Two Distinct, Focused Companies Gold Fields Ltd. announced on November 29 the proposed creation of a new South African gold mining company, Sibanye Gold Ltd., that will control Gold Fields' KDC and Beatrix gold mines in South Africa as well as various service companies. Gold Fields will retain the balance of its portfolio of assets, including the developing South Deep gold mine in South Africa, existing mines in Ghana, Peru and Australia, and an international portfolio of development and exploration projects. Outlining the economic rationale for splitting Gold Fields into two distinct companies, Gold Fields CEO Nick Holland pointed out that the share prices of major gold mining companies, including Gold Fields, have been flat or down over the past seven years, while "We've seen a gold price that has gone way beyond our wildest dreams." Looking for a way to deal with this disconnect, Gold Fields focused on the fact that it has two distinct types of mining assets: 1) mature, deep-level, narrow-vein, tabular orebodies in South Africa, typically dipping at 30° to 35°, mining 1- to 3-m reef packages, which means they are typically labor intensive; and 2) open-pit and shallow underground international operations, the exception being the massive, deep-level South Deep development in South Africa, which will be a fully mechanized operation. A decision was made to separate these asset types into two companies, rather than trying to manage their sometimes competing needs under a single corporate umbrella. KDC and Beatrix are mature operations that mine deep to ultra-deep, narrow-vein, tabular orebodies. Mining depths range from 600 m to 3,345 m below surface at KDC and from 600 m to 2,155 m below surface at Beatrix. In calendar year 2011, KDC produced 1.1 million oz of gold at total cash cost of $946/oz; Beatrix produced 347,000 oz at total cash cost of $957/oz. Production at both mines has declined steadily over recent years, and production costs per ounce have risen sharply. As of December 31, 2011, the two mines had a combined total of 22 million oz of gold in reserves and 79 million oz of gold in resources. Spinning off KDC and Beatrix into Sibanye Gold will create a company that can focus on the specific requirements of these operations and that will not have to compete with other Gold Fields operations for capital. Cash flows from KDC and Beatrix will stay with Sibanye Gold. Goals for the new company include reversing the declining production trend at the mines, extending the life of the mines, and ensuring the longterm sustainability of the company. Sibanye Gold will have more than 35,000 employees; nearly 26,000 at KDC and 9,250 at Beatrix. Neal Froneman, who was CEO of Gold One International, will become CEO of Sibanye Gold, and Charl Keyter, currently head of finance for Gold Fields' international operations, will become the CFO. Froneman was at one time vice president and head of operations at Gold Fields. Matthews S Moloko, currently a nonexecutive director of Gold Fields and executive chair and founder of the Thesele (Continued on p. 8) DECEMBER 2012 • E&MJ; 5